So you’ve decided to find a tax return preparer to help guide you through tax season! That’s great, but it’s also incredibly important to choose the right tax preparer for you and/or your family’s needs.

Did you know that around 80% of people never check the credentials of their tax preparer? No, it’s true. It’s also an incredibly unwise move, because we literally entrust our tax preparers with quite a detailed peek into our lives. Think about the kind of information that a stranger to your family could discover from your tax paperwork. No seriously, go pull it out right now and take a look. Everything from your family income, to your children’s names and dates of birth, to your bank account details and social security numbers – it’s all right there for your tax preparer to see. Now think about what an unscrupulous person could do with that information – scary, isn’t it? Moreover, regardless of who prepares your tax return, you are still responsible for the information that is submitted.

So, how do you avoid the trap of engaging the services of a bad tax preparer?

Check Credentials and Qualifications

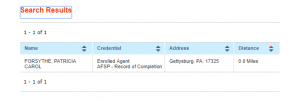

This is perhaps the easiest thing to check, because thanks to the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications tool, you can look into the credentials of any tax preparer before you even pick

up the phone. Don’t forget to also check out the Understanding Tax Return Preparer Credentials and Qualifications page to understand what you’re reading too!

Less official, but arguably equally important is the kind of word of mouth reputation that a tax professional has in a place. Look for a tax preparer who has retained the same clients for years in the same place. Reviews on Google and social media are great ways to do this.

Ask the Important Questions

When you get past the initial research stage, you’re going to want to contact the preparer and get more detailed information about them and their practices. Questions like “What are your service fees?”, “Do you E-file?”, and “Will you be available after April 18th?” may seem like run of the mill questions. But they can tell you a lot about a tax preparer and how they do business. For example, the IRS recommends that you avoid tax professionals who take a percentage of the return as their fee – this is a red flag. Tax return preparers who take on more than ten clients must E-file, and being unavailable after the 18th of April is a sure sign of a fly-by-night operation.

Whatever you do though, never hand over any of your paperwork at this stage, not until you have received satisfactory answers to these questions. Some unscrupulous tax professionals have been known to file on the behalf of others without having been contracted to do so. . Additionally, do not sign any blank tax returns, simply leave and report that preparer to the IRS here or here.

Final Tips

So you’ve hired your tax return preparer and are sitting before your (hopefully) completed tax return with all of the hard work taken care of. You are almost ‘home free’ for this tax year, however there are a few final things you need to look out for.

As with any legal document, it’s a good idea to review everything before signing. Do not sign until you have checked it and it all looks right. Remember, you are ultimately responsible for the information that is submitted to the IRS. Secondly, ensure that the preparer also signs the form and includes their PTIN, or Preparer Tax Identification Number. Finally, always keep a copy of your tax return, as you may need your Adjusted Gross Income Amount when you file next year.

In spite of this list of red flags to avoid when looking for a tax preparer though, it is worth always bearing in mind that the vast majority of tax return preparers are honest and trustworthy people. And if you find the right one, this tax season could be the start of a mutual beneficial relationship that may last for years to come.

Enrolled to Practice before the Internal Revenue Service

Certified Notary Signing Agent (National Background Screened)

Notary, Mobile Notary